Time limitsĭifferent time limits apply for making an application to the Court for financial orders depending on your individual situation. You should obtain legal advice about whether your circumstances satisfy the criteria before filing an application. Your relationship is not a de facto relationship if you were legally married to one another or if you are related by family. one party made significant contributions to the property of the other, and the failure to make an order would result in a serious injustice.the relationship is or was registered under a prescribed law of a state or territory, and/or.there is a child in the de facto relationship, and/or.the period for the de facto relationship was at least two years, and/or.

meet at least one of the following criteria:.have a geographical connection to a participating jurisdiction (which includes each Australian state and territory except Western Australia), and.The law requires that you and your former partner, who may be of the same or opposite sex, had a relationship as a couple living together on a genuine domestic basis.īefore the Court can determine your financial dispute, you must satisfy the Court that you were in a genuine de facto relationship with your former partner which has broken down, and that you: De facto relationshipĪ de facto relationship is defined in section 4AA of the Family Law Act 1975.

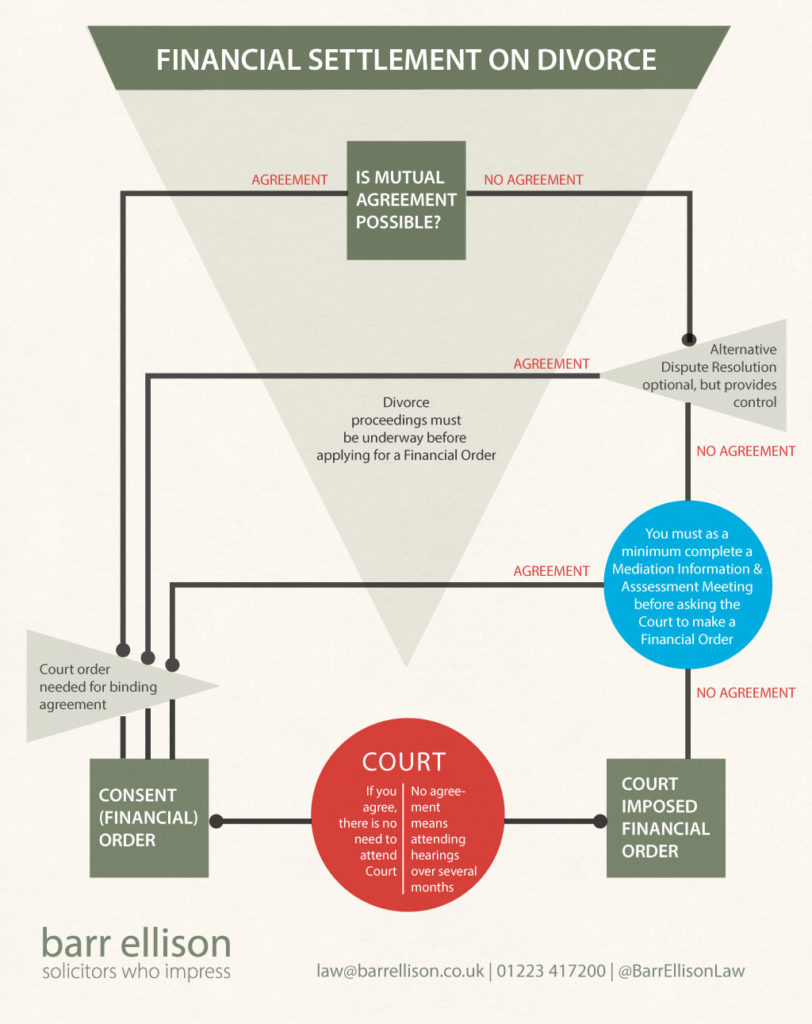

If a Court has made an order that your marriage was a nullity (the technical way of saying, that the marriage was void or that you were not validly married), you can still ask the Court to make financial orders arising out of that void marriage. You can ask the Court to make orders for property settlement or maintenance arising out of a marriage even if you are not yet divorced. The Court has power to make financial orders in relation to marriages (including void marriages) under Part VIII of the Family Law Act 1975. When can the Court make financial orders? Marriage This guide provides family law and consumer credit law information, options and referral points to assist separating couples to proactively manage debt in the context of relationship breakdown. Separating with debt: a guide to your legal options.This guide provides information to separating couples about the options for resolving property, financial and superannuation arrangements, from an informal agreement through to filing consent orders with the Court and litigating the matter in court. Property and Financial Agreements and Consent Orders – What You Need To Know.The following guides from the Attorney-General's Department provide information about finances and debt after separation: TIP: Divorce is a completely separate process to financial proceedings. If you cannot reach an agreement after dispute resolution, you can apply to the Court for financial orders, including orders relating to the division of property and payment of spouse or de facto partner maintenance.If you cannot agree on some issues, you can use dispute resolution or mediation to help you resolve any issue in dispute.If you agree on arrangements, you can seek to formalise your agreement by applying for consent orders or making a financial agreement.There are various ways you can make arrangements to divide your finances after separation: For more information about ways you may be able to reach an agreement without the need for Court action, see Separate smarter. Making your own agreement will save you both money, time and stress. If it is safe to do so, it is generally best if you can reach your own agreement with your former spouse or partner. One person may also need financial support from the other, either for themselves in the form of spousal or de facto maintenance (which can arise out of both a marriage or a de facto relationship), or for their child or children, in the form of child support or child maintenance.

DIVORCE FINANCIAL SETTLEMENT HOW TO

When people separate (whether from a marriage or a de facto relationship), they usually need to sort out how to divide their property and debts.

0 kommentar(er)

0 kommentar(er)